Changes to Casual Employment in August 2024

Casual employment is set to change again after Amendments to the Amendments to the Fair Work Act 2009 (Cth).

.

On the 26th August the following changes will come into effect:

· There is a new definition of casual employment

· The pathway for casuals to move to permanent employment has changed

· Issuing the casual employment information statement has a new arrangement

This information is applicable to national employers only and does not apply to employers in the state system.

New definition of casual employment

A new definition of ‘casual employee’ will be introduced. Under this definition, an employee is only casual if:

· There is no firm advance commitment to continuing and indefinite work; and

· They are entitled to receive a casual loading or specific casual pay rate

It is important to note that this definition will focus on the true nature of the employment rather than just the written terms of the employment contract. It’s important to be aware that even if there is an absence of a firm advance commitment to continuing and indefinite work the employment will be assessed on the basis of the ‘true nature’ of the employment relationship.

New pathway for converting from casual to permanent

The current rules for casual conversion are being abolished. An offer of permanent employment is no longer required for employers to offer casual employees.

Instead, it will be up to the employee to notify you of their intention to change to permanent employment if:

· They’ve been employed for at least 6 months (for employers with 15 or more employees) or 12 months (for employers with less than 15 employees); and

· They believe they no longer fit the definition of a casual employee.

Casual employment information statement (CEIS)

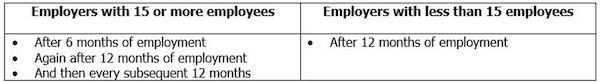

A new obligation will exist for providing the Casual Employment Information Statement (CEIS) to casual employees. In addition to providing the CEIS to casual employees on commencement, employers will now be required to provide the CEIS:

What you need to do?

· Review your casual workforce and assess these employees against the new definition

It is very important that employers ensure they meet their ongoing obligations under these new arrangements. Employers need to put a mechanism in place to remind them to meet the new obligation, see Table ablve, for issuing the Casual Employment Information Statement at the required times.

Hot Issues

- Why Might a Lease Dispute Occur?

- 2025 Tax Planning Guide Part 1

- $20,000 instant asset write-off

- New Bunnings scam warning

- The Largest Empires in the World's History

- All the documents, fact sheets and downloads to do with this year’s 2025-26 Federal Budget

- Winners and Losers - Federal Budget 2025-26

- Building Australia's future and Budget Priorities

- ATO outlines focus areas for SMSF auditor compliance in 2025

- ATO to push non-compliant businesses to monthly GST reporting

- ASIC pledges to continue online scam blitz

- Tax Office puts contractors on notice over misreporting of income

- Tax planning tips for 2024-2025

- What does the proposed changes to HELP loans mean?

- Vacant Residential Land Tax

- The Most Held Currencies in the World | 1850-2024

- Salary sacrifice and your super

- 5 Clauses Tenants Should Look For When Reviewing a Lease

- ASIC continues crackdown on dodgy directors

- Vehicle association calls for stricter definitions with luxury car tax changes

- Government to push ahead with GIC deduction changes

- Exploring compassionate early release of super

- Have you considered spouse contribution splitting?

- Best Selling BOOKS of all Time

- GST fraudsters to face ‘full force of the law’: ATO

- Social media scams dominate losses in 2024

Article archive

July - September 2024 archive

- Time for a superannuation check-up?

- Scam alert: fake ASIC branding on social media

- Millions of landlords the target of expanded ATO crackdown

- Government urged to exempt small firms from TPB reforms

- ATO warns businesses on looming TPAR deadline

- How to read a Balance Sheet

- Unregistered or Registered Trade Marks?

- Most Popular Operating Systems 1999 - 2022

- 7 Steps to Dealing With a Legal Issue or Dispute

- How Do I Resolve a Dispute With My Supplier?

- Changes to Casual Employment in August 2024

- Temporary FBT break lifts plug-in hybrid sales 130%

- The five reasons why the $A is likely to rise further - if recession is avoided

- June quarter inflation data reduces risk of rate risk

- ‘Bleisure’ travel claims in ATO sights, experts warn

- Taxing unrealised gains in superannuation under Division 296

- Most Gold Medals in Summer Olympic Games (1896-2024)

- Estate planning considerations

- 5 checklists to support your business

- Are you receiving Personal Services Income?

- What Employment Contracts Does My Small Business Need?

- The superannuation changes from 1 July

- Hasty lodgers twice as likely to make mistakes, ATO warns

- Landlords who ‘double dip’, fudge deductions in ATO crosshairs

- Most Spoken Languages in the World

What our clients say about us