ATO figures reveal final 2022 DPN tally

After a slow start in May, figures show how the office went up through the gears with director penalty notices.

.

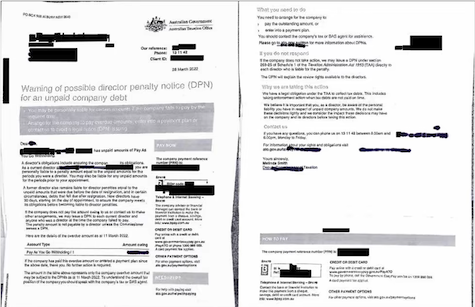

The ATO accelerated up through the gears on debt collection in 2022 to issue a total of almost 18,500 director penalty notices, figures released yesterday reveal.

The office also unsheathed a fresh weapon in its armoury by disclosing the tax debts of almost 500 businesses to credit referral agencies for amounts of $100,000 and above.

The final figures show that more than one in three directors failed to act after an April mail blitz by the ATO warned 52,000 directors about debts involving 30,000 companies.

By August, the ATO had issued 7,000 DPNs and was dispatching them at the rate of 120 a day. For the final five months of the year, it was also referring about 20 businesses a day to credit agencies after sending warning letters to more than 29,000.

The ATO said its debt recovery campaign, suspended during the pandemic, had been a success.

“We’ve seen an encouraging response to our letter campaigns, with a significant level of clients making payments or entering payment plans,” an ATO spokesperson said.

“The value of debt owed by clients at the start of the campaigns was $17.3 billion. As a result of these two campaigns, over $714 million has already been paid in full and a further $5.4 billion is now actively managed under payment arrangements.

“For those that have not responded we have progressed to issuing DPNs and disclosing the tax debt information of eligible businesses.

“In the 2022 calendar year, we issued almost 18,500 DPNs to individual directors in respect of more than 13,500 companies for unpaid GST, income tax withholding, and superannuation guarantee charge.

“In relation to Disclosure of Business Tax Debt, we disclosed nearly 500 businesses in 2022 to credit reporting agencies.”

The result of the ATO campaign also showed up in final insolvency figures for 2022, released by ASIC.

They revealed 4,806 total appointments over companies for the second half of 2022, a rise of 51 per cent of the corresponding period in the previous year.

Philip King

19 January 2023

accountantsdaily.com.au

Hot Issues

- Why Might a Lease Dispute Occur?

- 2025 Tax Planning Guide Part 1

- $20,000 instant asset write-off

- New Bunnings scam warning

- The Largest Empires in the World's History

- All the documents, fact sheets and downloads to do with this year’s 2025-26 Federal Budget

- Winners and Losers - Federal Budget 2025-26

- Building Australia's future and Budget Priorities

- ATO outlines focus areas for SMSF auditor compliance in 2025

- ATO to push non-compliant businesses to monthly GST reporting

- ASIC pledges to continue online scam blitz

- Tax Office puts contractors on notice over misreporting of income

- Tax planning tips for 2024-2025

- What does the proposed changes to HELP loans mean?

- Vacant Residential Land Tax

- The Most Held Currencies in the World | 1850-2024

- Salary sacrifice and your super

- 5 Clauses Tenants Should Look For When Reviewing a Lease

- ASIC continues crackdown on dodgy directors

- Vehicle association calls for stricter definitions with luxury car tax changes

- Government to push ahead with GIC deduction changes

- Exploring compassionate early release of super

- Have you considered spouse contribution splitting?

- Best Selling BOOKS of all Time

- GST fraudsters to face ‘full force of the law’: ATO

- Social media scams dominate losses in 2024

Article archive

January - March 2023 archive

- Capital gains tax

- Using your business money and assets for private purposes

- Comparison: How Long It Takes To Decompose?

- Details of tax calculation for $3m threshold a 'mixed blessing

- Sharing economy reporting regime commences soon

- Later retirement takes oldies back to living in ’70s

- Changes to working from home deduction - started 1 Jul 2022

- Accountants face client backlash over blizzard of tax changes

- ATO figures reveal final 2022 DPN tally

- Residential rental properties

- Did you pay your superannuation guarantee payment late?

- Five new year’s tax resolutions

- ATO issues fresh warning on illegal early access schemes

- Looming changes for the “buy now, pay later” market

- Changes to Australian Business Number (ABN) registration compliance

- 100 Most Influential people in the world.

- How crypto assets can trigger CGT tripwires

- ATO targets dodgy deductions for holiday homes

- Tips for small business owners

- About the working from home safety and wellbeing checklist

- Countries with the highest GDP per capita between 1800-2040

- Downsizer age reduction now in force

- Raids stop $33m in tax avoidance, ATO claims

- 100A ruling leaves trust decisions haunted by ‘uncertainty’

What our clients say about us